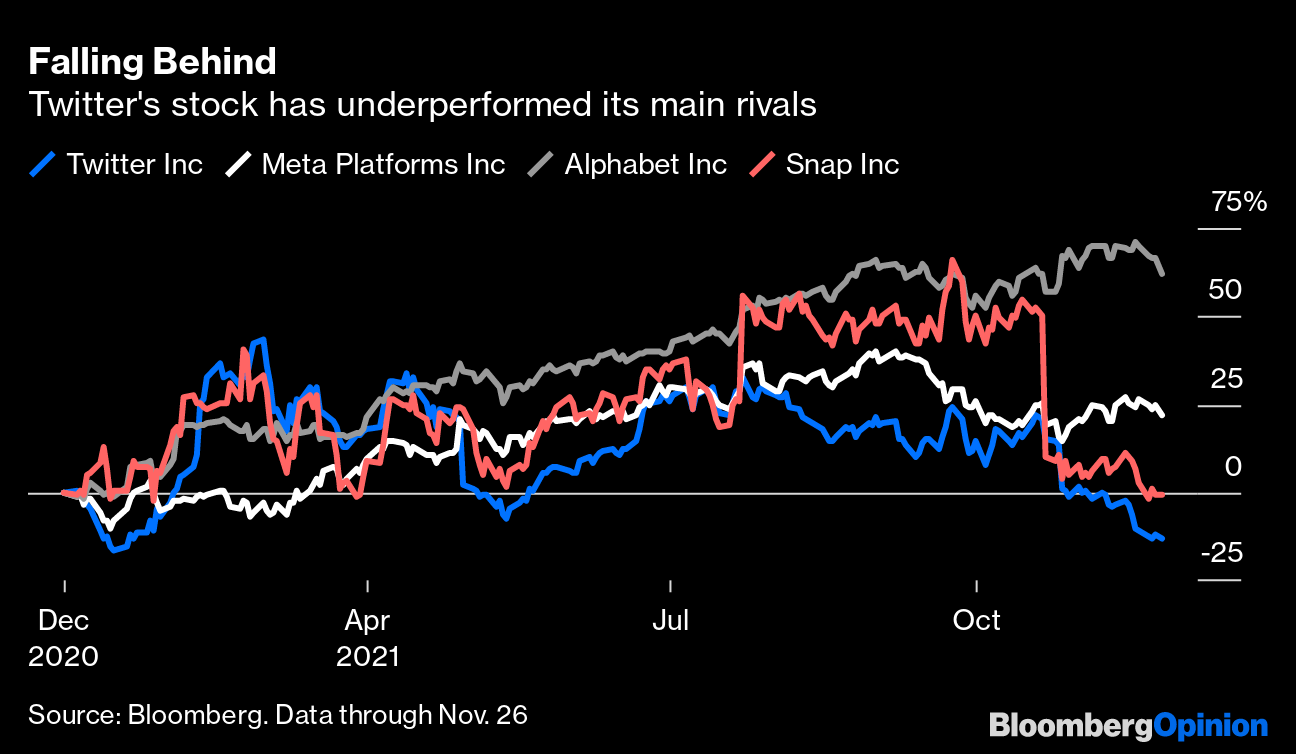

| This is Bloomberg Opinion Today, a therapy session of Bloomberg Opinion's opinions. Sign up here. Many Americans had their leftover turkey and ambrosia salad ruined by news that a new (not "nu") Covid variant of concern had dropped, followed hard by financial markets and the gates on various countries barring travelers from omicron hotspots. Some people might say this "panic first, ask questions later" response is unhealthy. I call those people "my therapist." It certainly has its drawbacks. But Therese Raphael suggests it's actually a step up from the way many countries snoozed at other stages of a pandemic now approaching its second unhappy birthday. And so far the precautions make sense, writes Faye Flam, particularly the rush to remold vaccines to match omicron. As for the fear that gave us the most indigestion — that omicron will reverse two years of progress fighting Covid — Faye writes it's highly unlikely. Diseases can only mutate so much. Sometimes they even get less deadly (see: all of the common colds). It's far too soon to say omicron will be a gentler version of Covid or strong enough to wipe out delta. But it's also far too soon to lose all, or even most, hope. That shouldn't keep us from speculating wildly about the potential economic repercussions. To the extent it hurts activity at all, that could weigh on prices, particularly commodities such as oil. The world's least popular supergroup, OPEC+, meets this week with all kinds of new reasons to cap oil production, writes Julian Lee. And central bankers might have an excuse in omicron to drag their feet on tightening policy, writes Marcus Ashworth. Then again, Mohamed El-Erian argues inflation is unavoidable, so what we might get from an omicron slowdown is stagflation. If the variant keeps dock workers and truck drivers home again, then that could raise prices and make inflation even worse, warns John Authers. Certainly omicron has inflamed other pre-existing conditions. Republican conspiracy theorists used the variant to construct moronic new cathedrals of paranoia before our eyes, writes Jonathan Bernstein. Crypto enthusiasts jumped on a crypto thing called Omicron either from confusion or a quest for lulz, notes Mark Gongloff. Sometimes it's worth asking the questions right at the start.  | In last night's episode of "Succession," Logan Roy called off deal talks because his merger target sent insufficiently important negotiators. Unless a toxic legacy is your goal, you should generally avoid using the Roy patriarch as a role model. But in the case of Iranian nuclear talks, the U.S. might want to channel its inner Logan. Bobby Ghosh points out Tehran refuses direct contact with the U.S., part of an effort to make negotiations more painful and protracted, buying time to work on nukes while avoiding sanctions. Bobby writes the U.S. should short-circuit this nonsense by playing Royesque hardball. (While it's bringing "Succession" to life, the U.S. government should also seriously look into making Tiny Wu Tang happen.) Bonus Nuclear Reading: Setting unilateral limits on the use of nukes, as President Joe Biden might do, will backfire. — Bloomberg's editorial board A key lesson of financial crises is that the risks you don't see are the ones that hurt the most. By now, we're all painfully familiar with the many risks facing China's property developers. But Shuli Ren points out they also have untold billions of dollars in private offshore loans, the size and timing of which are hard to quantify. Worse, because these lenders aren't under Beijing's control, they'll have no qualms about squeezing developers. Investors in U.S.-listed Chinese stocks woke up to a whole new set of risks last week after reading reports that Beijing wants DiDi Global to pull its New York listing. Tim Culpan notes China's dubious rationale could apply to just about any company, suggesting there are many more rug-pulls to come. Today Jack Dorsey has one less job and Twitter has a new CEO. Considering Twitter's lagging stock price, Parag Agrawal doesn't exactly have big shoes to fill. And now he has a handy playbook from Tae Kim about some easy tweaks that could revive Twitter's fortunes.  Inflation-linked bonds share little of the punditry's panic about an endless inflationary nightmare, writes Matthew Winkler.  History suggests the U.S. is more at risk of falling apart than you might think. — Max Hastings Brazil throwing fiscal caution to the wind and damaging its currency could lower global commodity prices. — David Fickling Mario Draghi and Emmanuel Macron are Europe's dynamic duo. — Rachel Sanderson Brexit has made France even more responsible for U.K. border control, and it's not happy about it. — Lionel Laurent An Israel-Jordan deal on water and electricity shows the future of Middle East diplomacy. — Zev Chafets Getting to net zero will require more and faster government investment in cutting-edge technologies. — Clara Ferreira Marques How to get your taxes ready for the Democratic tax plan. — Alexis Leondis "Pension poachers" are preying on veterans. Goldman Sachs is adding benefits to fight burnout. Lawmakers want to crack down on bots buying hot toys. Which birds are the pushiest jerks at the feeder? (h/t Ellen Kominers) Archaeologists find an ancient Roman mosaic in the U.K. (h/t Alistair Lowe) RIP to Mr. Goxx, the crypto-trading hamster. (h/t Mike Smedley) Watch Paul McCartney mold random sounds into "Get Back" in less than two minutes.  Notes: Please send bird seed and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |